When global supply chains are threatened, reshoring increases

It is better to manufacture closer to your market and pay a higher price than to lose sales and get dissatisfied customers. That is why several Swedish companies have decided to bring production back home.

“Production costs in so-called low-pay countries have increased and over time approached EU levels. That is true, particularly for manufacturing with high levels of automation, such as advanced manufacturing processes in electronics production or the production of medical technology and pharmaceuticals.

"In those cases, wage cost differences are so small that there are no longer significant gains to be had from keeping production abroad,” Martin Grauers tells the Nordic Labour Journal.

He set up the Reach consultancy agency in the mid-2010s, to help customers with manufacturing and logistics as well as with relocating or optimising operations. Today, he is the CEO of the Swedish branch of DANX, a logistics company specialising in just-in-time deliveries, primarily of spare parts for IT and automotive companies.

"As a Swede and part of the business community, I have tried to find production opportunities in Sweden. After witnessing successful examples of relocating operations back home, the interest has remained strong and this is also a matter of public interest."

Demands for greater flexibility

There are other reasons than reduced wage differences that make Swedish companies bring production back home. The pandemic and recent events like the Suez Canal becoming blocked by a shipping accident in 2021 have influenced Swedish companies’ interest in reshoring, believes Martin Grauers.

“When there are global disruptions, companies realise they cannot deliver to customers as efficiently as they had promised. The distance causes significant disruptions while within Europe, distances only mean a couple of days' transport to where the market is. That flexibility has value in itself," he says.

Another reason for bringing production back is to protect critical societal functions to secure access to products, such as defence-related items or access to medicines and medical equipment.

"There is value in choosing countries with low political risk and not having production in risky countries where it could fall into the wrong hands," says Martin Grauers.

The power of technological development

Yet another reason is the development in automation and the modernisation of robots – both traditional industrial robots and so-called cobots, collaborative robots which are follower robots meant to directly interact with humans in a shared environment.

A cobot works together with a person and does the heavy lifting. Here food is packed by a cobot and a human. Photo: International Federation of Robotics.

“The cobots can be used for parts of production that for instance involve a lot of repetition and is not that suited for humans,” says Martin Grauers. He also points to what Industry 5.0 can mean for the reshoring of production.

“Industry 5.0 affects everything that has to do with AI. How you control machines and how to make production more cost-efficient through creating very efficient production chains for the type of products that can be automated.”

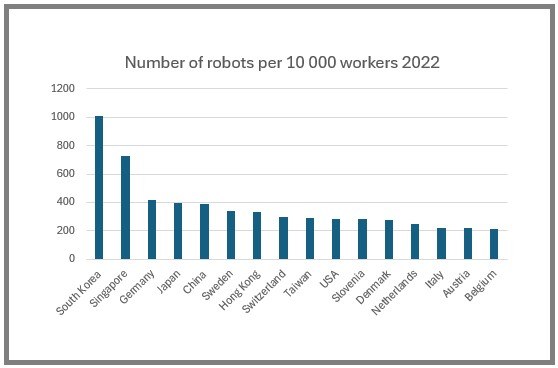

Both Sweden and Denmark are among the countries that had the most robots per 10,000 workers in 2022. Source: International Federation of Robotics.

The environment wins

Martin Grauers assumes that environmental and sustainability aspects are important and that they are definitely contributing factors when companies choose to locate production in Sweden.

“The more local production the fewer long-distance transports which is good for the environment,” he says.

He also sees the advantages of having production close by when it comes to ensuring that the entire production chain remains green.

“This makes it easier to control the entire chain to see whether it is sustainable. It also makes it easier to assess and measure whether for instance steel or other energy-intensive raw materials have been manufactured with clean electricity or dirty coal power.”

Martin Grauers does not, however, believe that environmental and sustainability issues are the driving forces behind the reshoring of production.

“The overall trend is so large that it would have happened even if we did not care about the environment and sustainability. These are definitely contributing factors, but not the ones driving the reshoring of production.”

“Instead, it is the technology that makes it cheaper and more efficient to have production close to the other business units," notes Martin Grauers, who believes that the reshoring of production is a strong trend.

A trend where two factors determine whether production that was previously moved abroad will return to Sweden and be successful, creating more jobs here.

Challenges with reshoring

One of the challenges is the access to the necessary skills which are different today than those needed in the past.

Even if the robots do the work, like at this Jeep factory in Toledo, Ohio, engineers and maintenance personnel are still needed. This plant produces 828 vehicles every day. Photo: International Federation of Robotics /KUKA.

“Production is largely about automation and more modern manufacturing. For that, you need access to engineers and automation engineers as well as maintenance personnel. This availability becomes a crucial issue if production in Sweden is to increase,” he says and points out that there is a structural skills shortage.

“It requires both the business sector and not least politicians to take responsibility for making investments to develop the skills needed created by this trend.”

The other challenge identified by Martin Grauers is access to reliable, clean and cheap electricity.

“There are companies that hesitate to invest in Sweden because they cannot be guaranteed the electricity they need,” he says.

Despite all this, there is a lot pointing towards a kind of renaissance of manufacturing industries in Sweden, believes Martin Grauers. He notes that many contract companies have grown in Sweden in recent years.

“We are moving towards regional manufacturing chains rather than having production in one part of the world and sales in another There are clear and good examples that Sweden has an opportunity to attract a lot of manufacturing.”

Sweden stands out

Comparatively, Swedish companies are reshoring production to a greater extent than other countries do, explains Jan Olhager, who was a professor of strategic production technology at Lunds University of Technology until recently, and is now emeritus.

He tells the Nordic Labour Journal about the two studies he conducted on reshoring. The first covered the period 2015 to 2020, and the other – a follow-up study – covered 2020 to 2022.

He tells the Nordic Labour Journal about the two studies he conducted on reshoring. The first covered the period 2015 to 2020, and the other – a follow-up study – covered 2020 to 2022.

“The first study showed that Swedish companies brought home nearly as much production as they were moving abroad. From an international perspective, this is a lot, and both Denmark and Finland lag behind. The rest of Europe even more so,” he says.

In this study, the main reason for reshoring turned out to be the quality of the products delivered.

“The quality outcomes were not what was expected when moving production abroad. This in turn led to delivery issues which then became cost problems. Lead times, the proximity to product development and, to some extent, proximity to the market, also played a role," he says.

A new not-normal post-pandemic

During the pandemic, short lead times became the dominating argument for reshoring production, as Olhager’s follow-up study shows.

“The pandemic disrupted things and the main reason for reshoring production was no longer quality, although that remained important. Now it was much more about creating shorter supply chains,” says Olhager.

Factors like lead time, proximity to the market and product development dominated the survey responses. Quality fell from being reason number one to number four in this second study.

While the pandemic lasted, some companies were forced to create shorter supply chains to make them function again, while others held back from both reshoring and moving production out. There were far too many unknowns, says Jan Ohlager.

“It is hard to say what triggers reshoring today. During the pandemic, various geopolitical events might have had an effect. It made companies realise that the world around them had changed making it impossible to return to the situation such as it was before the pandemic. Now you have to find a new position to work from,” he says.

Finally

So what is it that makes Sweden stand out from other countries when it comes to the reshoring of production? The reasons are difficult to determine, believes Jan Olhager.

“Sweden has no state subsidies for reshoring like those that exist primarily in the USA. Nor have we made the kind of investments that Germany did during Industry 4.0 which focused on automating domestic production.

“However, the sustainability discussion which Sweden has had for several years might be a contributing factor to why Swedish companies are considering reshoring the production for sustainability reasons.”

- Jack-knifed in the Suez Canal

-

On March 23, 2021, the 400-meter-long container ship Ever Given became stuck across the Suez Canal, blocking traffic for six days before 14 tugboats managed to dislodge it. The canal, only 300 meters wide with frequent strong winds, was ill-suited to accommodate a ship of that size in such conditions. On March 28, a queue of 369 ships formed, carrying cargo valued at a combined $9.6 billion, all waiting to transit the canal. Approximately 12 per cent of global trade flows through the Suez Canal.

Follow us on Facebook

Follow us on Facebook